To protect your business and price your product for profitability, you must look beyond that initial quote. The solution is to master the calculation for the total Landed Cost of Body Trimmer units. This figure—not the factory price—is the true cost of getting each item into your warehouse. This guide provides a clear, step-by-step framework to master this crucial calculation, ensuring every dollar is accounted for.

For any brand, especially a startup, one of the most dangerous mistakes is to build a budget around the factory price alone. That tempting $10 per-unit cost on a supplier’s quote is merely the tip of the iceberg. Overlooking the myriad of "hidden" expenses is the fastest way to see your profit margins vanish.

The Core Formula: Understanding the Components

At its heart, the formula for your total landed cost is straightforward. It’s the sum of all costs associated with getting the product from your manufacturer's door to yours. We can break it down into four main pillars:

Total Landed Cost = Product Cost + Shipping & Freight Cost + Customs & Duties + Risk & Compliance Costs

The key is to accurately calculate each of these components. Let's dive into each one.

1: Product Cost - It's All About the Incoterms

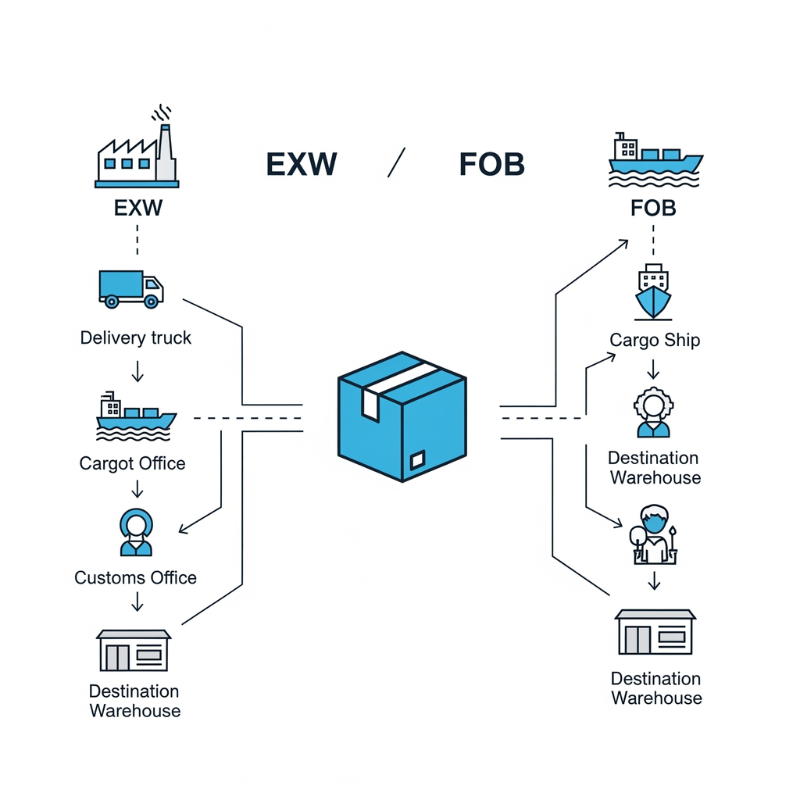

The "price" your supplier gives you can mean different things. This is governed by Incoterms, a set of universal rules for international trade. For importing body trimmers, you'll most commonly encounter two:

- EXW (Ex Works): This is the literal price of the product sitting at the factory door. You, the buyer, are responsible for arranging and paying for all logistics, including trucking it from their factory to the port, clearing it for export in the origin country, and everything that follows. This option gives you full control but carries high risk and complexity if you are not familiar with the origin country's logistics.

- FOB (Free On Board

): This price includes the cost of the product PLUS all the costs to get it onto the shipping vessel at the designated port (e.g., FOB Shenzhen). The supplier handles local trucking and export customs. This is the preferred term for most importers as it simplifies the process and places the local logistical risk on the supplier.

Pro Tip: Always confirm the Incoterms with your supplier. A $9.50 EXW price might seem cheaper than a $10.00 FOB price, but after you factor in local Chinese logistics, the FOB option is almost always more cost-effective and secure.

2: Shipping & Freight Costs

This is the cost of physically moving your goods across the globe. It's a variable cost that requires getting quotes from a freight forwarder—a company that acts as your logistics agent.

Key costs in this category include:

- Ocean Freight vs. Air Freight: Air freight is much faster (days vs. weeks) but can be 5-10 times more expensive than ocean freight. For a bulk order of body trimmers, ocean freight is the standard choice unless you have an urgent deadline.

- Freight Forwarder's Fees: This is the service fee for their work, which includes booking space on a vessel, handling documentation like the Bill of Lading, and coordinating the shipment.

- Cargo Insurance: This is non-negotiable. It protects you against loss or damage during transit. The cost is a small percentage of your goods' total value but can save you from catastrophic loss.

- Local Delivery: The cost of trucking your shipment from the destination port (e.g., Port of Los Angeles) to your final warehouse or fulfillment center.

3: Customs, Duties, and Taxes

Once your goods arrive in the destination country, the government will want its share. This is often the most confusing part of the landed cost calculation.

- Customs Duty / Tariffs : This is a tax calculated as a percentage of your goods' total value (product cost + shipping + insurance). The percentage is determined by your product's "HS Code" (Harmonized System Code). An electric body trimmer has a specific HS code (e.g., 8510.20), and you must use this code to find the correct duty rate for your country.

- Merchandise Processing Fee (MPF): A fee charged by U.S. Customs and Border Protection.

- Value Added Tax (VAT) / Goods and Services Tax (GST) : Many countries levy an additional tax on imported goods, which you must pay upfront.

Pro Tip: Your freight forwarder will usually have a customs brokerage service to handle these calculations and filings for you. It is crucial to classify your product correctly to avoid fines and delays.

4: Risk & Compliance Costs (The "Hidden" Fees)

These are the costs that new importers often forget to budget for, but they are essential for a successful procurement cost strategy.

| Cost Category | Description & Example | B2B Importance |

| Quality Control Inspection | Hiring a 3rd-party to inspect goods before shipment (e.g., $300 per inspector-day). | Prevents paying for and shipping defective products. A must-have for any significant order. |

| Payment Processing Fees | International wire transfer fees (e.g., $25-$50 per transaction). | Small but adds up. Needs to be factored into the per-unit cost. |

| Product Certification | Costs for CE, FCC, RoHS testing if not covered by the supplier's quote. | Legally required for market access in the EU/USA. Cannot be skipped. |

| Contingency Buffer | An extra 5-10% of the total cost set aside for unexpected delays, price hikes, or issues. | A crucial risk management strategy for protecting your profit margins from unforeseen events. |

Putting It All Together: A Calculation Example

Let's calculate the estimated Landed Cost of Body Trimmer units.

- Order: 2,000 units

- Product Cost (FOB Shenzhen): $10/unit = $20,000

- Ocean Freight & Insurance: $1,800

- US Customs Duty (e.g., 4%): ($20,000 + $1,800) * 4% = $872

- US MPF & other fees: ~$200

- Local US Trucking: $500

- QC Inspection: $300

- Contingency Buffer (5%): ($20,000 + $1,800 + $872 + $200 + $500 + $300) * 5% = $1,183.60

Total Cost: $20,000 + $1,800 + $872 + $200 + $500 + $300 + $1,183.60 = $24,855.60 True Landed Cost Per Unit: $24,855.60 / 2,000 = $12.43

As you can see, the true cost is nearly 25% higher than the initial factory price.

Conclusion: Calculate to Dominate

Failing to perform an accurate landed cost calculation is a gamble you can't afford to take. By meticulously accounting for every component—from product and freight to duties and risk—you move from guessing to knowing. This detailed understanding of your total landed cost is the foundation upon which you can build a sustainable pricing strategy, protect your profit margins, and make informed decisions that will set your brand up for long-term success.